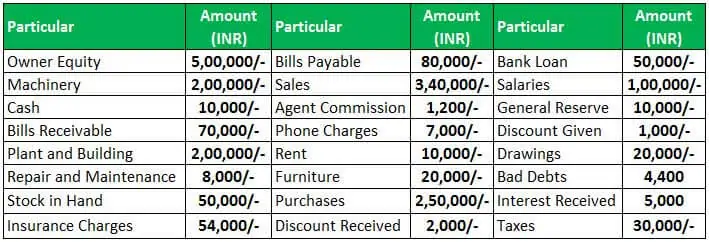

how to prepare trial balance? please give example

its just that you have to identify which one is credit and which one is debit

EXAMPLE

CAPITAL- it is always in credit side. so it will be written in credit side

Purchase- it is always debit side to it will b written in debit side.

Sales- this always comes in credit side so it will be written in credit side.

Machinery- it always be in the debit side so it will be written in debit side